Delhi, India:

In its latest monetary policy review held in August 2025, the Reserve Bank of India (RBI) decided to keep the repo rate unchanged at 5.5%, signaling a cautious but optimistic approach to India’s economic landscape. While the central bank chose to maintain status quo on key rates, it surprised the market by lowering the Consumer Price Index (CPI) inflation forecast for FY26 to 3.1%, indicating strong confidence in price stability in the near term.

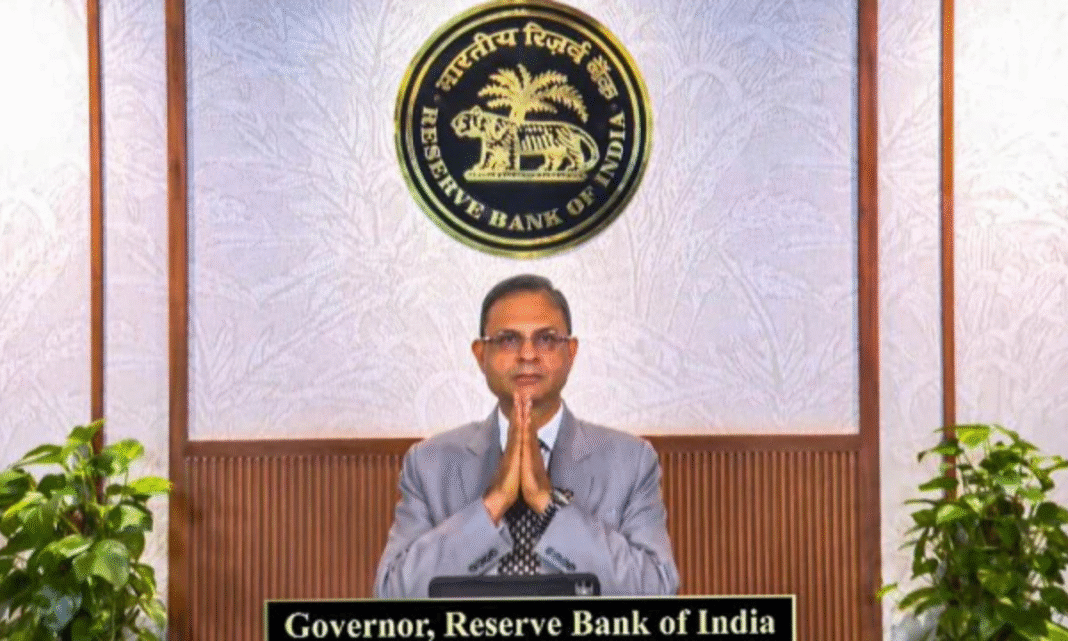

The decision to keep the repo rate unchanged for the seventh consecutive time reflects the RBI’s wait-and-watch approach amid evolving global and domestic dynamics. RBI Governor Shaktikanta Das, in his post-policy statement, emphasized that the Indian economy remains resilient and continues to recover steadily from global headwinds. According to the RBI’s Monetary Policy Committee (MPC), the current stance of “withdrawal of accommodation” remains appropriate to anchor inflation expectations while supporting growth.

Inflation, which had remained a major concern over the past few years due to geopolitical tensions, rising crude oil prices, and supply chain disruptions, appears to be easing consistently, according to the RBI’s projections. The CPI inflation forecast for the current fiscal (FY25) has also been retained at 4.5%, while the FY26 estimate has been revised down sharply from the earlier 3.6% to 3.1%. This projection suggests that inflation may move closer to the lower end of the RBI’s medium-term target of 4% (+/- 2%).

The move brings cheer to households and businesses alike. Lower inflation expectations may lead to reduced cost pressures on essentials and consumer goods, potentially boosting demand and economic activity. However, analysts suggest that despite the lower inflation forecast, the central bank may not rush into cutting interest rates in the near future.

On the growth front, the RBI retained its GDP growth projection for FY26 at 6.8%, reflecting confidence in domestic consumption, investment revival, and export momentum. The Governor also noted improvements in core sectors, services, and manufacturing, which together support a broad-based economic recovery.

Importantly, the RBI highlighted several global risks, including volatility in crude oil prices, geopolitical developments in the Middle East and Eastern Europe, and uncertain monetary policy paths of advanced economies like the US and the Eurozone. These factors continue to impact global financial markets and may influence domestic inflation in the medium term.

From a market perspective, the RBI’s tone was measured and balanced. While bond markets reacted positively to the lower inflation forecast, equity markets remained range-bound, awaiting further cues on future rate movements. Banking and auto stocks saw some gains, riding on the optimism that borrowing costs will remain stable in the near term.

The central bank also stressed the importance of fiscal prudence, digital transformation in the banking sector, and the need for deeper reforms in the financial system to maintain long-term macroeconomic stability.

For borrowers and lenders, the unchanged repo rate means home loan and personal loan EMIs are likely to stay stable for now. However, those waiting for interest rate cuts may need to wait a few more quarters unless inflation drops further and sustainably.

In summary, the August 2025 RBI policy indicates that the central bank is firmly in control of inflation, cautious on growth risks, and focused on maintaining stability amid global uncertainties. While the unchanged repo rate may not thrill investors, the lower inflation forecast suggests strong macroeconomic fundamentals that could support India’s growth story going forward.

Read more…India Win Oval Thriller, Series Drawn 2-2 vs England